straight life policy formula

A straight line basis is a method of computing depreciation and amortization by dividing the difference between an assets cost and its expected salvage value by the number of. Purchase price and other costs that are necessary to bring assets to be ready to use.

Manifest Good Grades Cover Good Grades Manifestation Grade

Straight life insurance is a type of permanent life insurance.

. If you select Fiscal in the Depreciation year field straight line life remaining depreciation is used. The goal of a permanent policy is to have life insurance in place for the rest of your life. With a straight life policy a portion of your premium pays for the insurance and the rest accumulates tax.

For example if the rate is 02 per 1000 and an enrollee elects 15000 in coverage the monthly premium will be 3. The guaranteed death benefit can help replace a familys. Solved Example For You.

This traditional life insurance is sometimes also known as whole life insurance or cash value insurance. Depreciation is calculated based on the fiscal years remaining. Straight life insurance is more commonly known as whole life insurance.

Straight line basis is the simplest technique used to compute the value. The primary unit for figuring out a life insurance rate is the rate per thousand cost per 1000 of insurance which can vary depending on which factors influence it age gender etc. The formula for calculating the periodic.

February 27 2022. A straight life annuity is an investment contract that make regular payments to the annuitant for the rest of their life. Prepare the necessary ledger accounts in the books of Anil for the year ending 31 st December every year.

For example for the fiscal year July 1 2015 through June 30 2016 the depreciation calculation starts on July 1. 1 8 x 100 125 per year. After death however the payments cease and the policyholder does not name a beneficiary.

The useful life of the machine is 3 years and its estimated residual value is 40000. Like all annuities one may buy the plan with a lump sum or with a series of payments over a number of years usually ending. The number of years that company expects to use an asset.

This method is most commonly applied to intangible assets since these assets are not usually consumed at an accelerated rate as can be the case with some tangible assets. Every time you pay your premium a portion goes towards maintaining your life insurance policy and the rest goes to the cash. A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy.

Rate of depreciation of an asset having a useful life of 8 years is 125 pa. A whole life policy in which premiums are payable as long as the insured lives. With the life expectancy of retirees continuing to lengthen having a guaranteed life.

Anil purchased a machine on 1 Apr 2015 for 400000. A straight life insurance policy is a type of permanent insurance that provides a guaranteed death benefit and has fixed premiums. It is also known as ordinary life insurance or whole life insurance.

Other common methods used to calculate depreciation expenses of fixed assets are sum of years digits double-declining balance and units produced. The fiscal year can be longer or shorter than 12 months. At the end of its useful life the machine is sold for 50000.

Such type of insurance helps your family prepare for the sudden. The straight line basis is a method used to determine an assets rate of reduction in value over its useful lifespan. Estimated assets value at the end of useful life.

International Risk Management Institute Inc. 02 x 15 3. Straight line amortization is a method for charging the cost of an intangible asset to expense at a consistent rate over time.

While more expensive than term life insurance straight life insurance offers the opportunity to build cash value. In addition company needs to spend 10000. Straight Life An annuity or other insurance plan that provides the policyholder with monthly payments for the remainder of hisher life.

Upon death the payments stop and you cannot designate a beneficiary with this type of insurance. Straight Line Basis. 12222 Merit Drive Suite 1600 Dallas TX 75251-2266 972 960-7693 800 827-4242.

Rate of depreciation. The straight life annuity choice gives the retiree an income he cannot outlive. Typically you buy one and make regular payments during your working life or pay a single lump sum usually after retirement.

Rate of depreciation can be calculated as follows. Company ABC purchases new machinery cost 100000 on 01 Jan 202X. A straight life insurance policy can also build cash value over time.

Rate of depreciation is the percentage of useful life that is consumed in a single accounting period.

The Structure Of Glucose Structural Formula Pearson Education Anatomy And Physiology

Methods Of Depreciation Learn Accounting Method Accounting And Finance

Can T Wait To Try This Exercise Get Fit Health Fitness

The Best Beauty Products You Can Buy From Your Friends Rodan And Fields Life Changing Skincare Rodan

Depreciation Methods Principlesofaccounting Com

The Simplest And Most Commonly Used Method Straight Line Depreciation Is Calculated By Taking The Purchase Or Acquisitio Business Valuation Method Subtraction

Interact Quiz Review Using Quiz Software For Better Lead Generation Lead Generation Lead Generation Marketing Generation

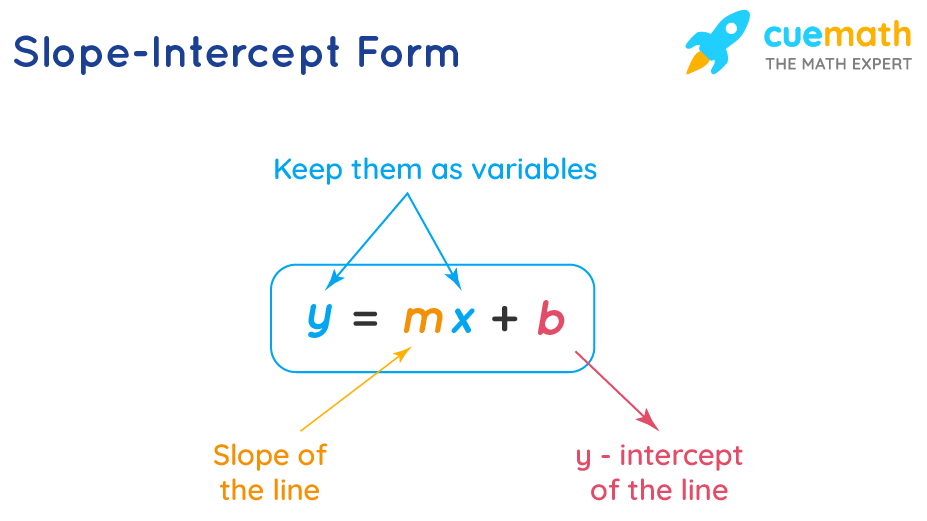

Y Mx B What Is Meaning Of Y Mx B How To Find Slope And Y Intercept

Salvage Value Formula Calculator Excel Template

Tinkrpostr Solid Geometry Visual Reference For Makers And Learners Poster By Joseph Ricafort Geometry Formulas Math Formulas Solid Geometry

Business Valuation Veristrat Infographic Business Valuation Business Infographic

Straight Line Depreciation Formula Guide To Calculate Depreciation

Depreciation Formula Calculate Depreciation Expense

Two Point Form Formula Derivation Examples

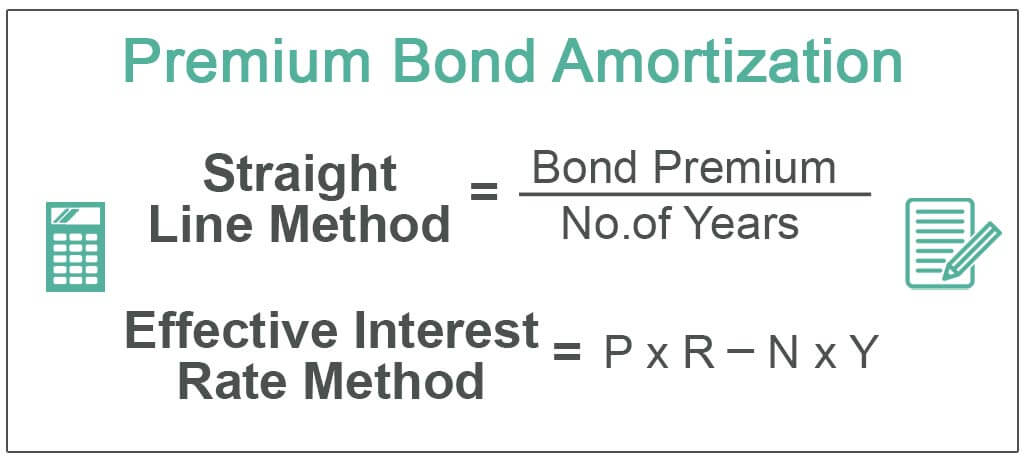

Amortization Of Bond Premium Step By Step Calculation With Examples

Geometry Angles Printable Visual Aid Kidspressmagazine Com Geometry Angles Math Visuals Geometry Notes

Straight Line Depreciation Formula Guide To Calculate Depreciation

Bottle Feeding Moms Breastmilk Or Formula Feel More Judged Every Time They Pull Out A Bottle In Public Than Yo Breastfeeding New Baby Products Bottle Feeding